inherited annuity tax calculator

An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or beneficiaries. What can or cannot be done with an inherited IRA and how distributions from the account are made both depend on who the beneficiary is or beneficiaries are.

If you dont youll face a 50 penalty on any money remaining in the account.

. If the annuity was an IRA annuity the SECURE Act that went into effect on January 1 2020 stipulates that if you inherit an IRA youll now generally have 10 years after the account holders death to withdraw all the money. This allows partners to enjoy the same tax-deferred benefits as the original annuity owner. Here you would sell a period of the annuity disbursement or a portion of each payment.

Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars. Qualified Inherited Annuities All death benefits will be subject to taxes. This difference affects many aspects of how the two types of annuities can be used for retirement planning.

How taxes are paid on an inherited annuity will depend on the payout structure selected and the. After that age taking your withdrawal as a lump sum rather than an income stream will trigger the tax on your earnings. The earnings are taxable over the life of the payments.

Nonqualified Inherited Annuities Only the interest earned will be subject to taxes. According to the Internal Revenue Service spouses calculate the tax-free part of received annuity payments the same way the primary annuitant did. Fixed Length Fixed Payment Result You can withdraw 551120 monthly.

Youll have to pay income taxes that year on the entire taxable portion of the funds. A financial advisor can help you handle an inherited annuity whether its qualified or not. But if you want to defer taxes as long as possible there are certain.

So if you have an annuity that promises payments for the next 10 years you could sell five years of these payments. In that instance any taxes owed on distributions would be deferred. If you change your answer to no part of the distribution was not an RMD your problem should go away.

Unfortunately gains are distributed first. Please use our Annuity Calculator to estimate the end balance of an annuity for the accumulation phase. So for instance if the annuity has 50000 in.

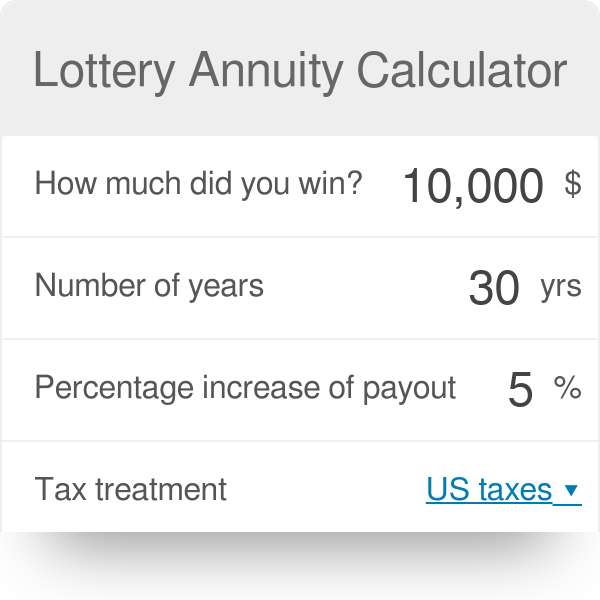

This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount. Tax Rules for Inherited Annuities. Withdrawals may be subject to regular income tax and if made prior to age 59 may be subject to a 10.

If they come from his employer then they are probably qualified plans subject to RMD if he was over the age of 70 12 when he passed away. Because your wife chose to cash in the annuity a portion of what she received will be income. Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account.

For example assume that you inherit an annuity from your spouse and you choose to stick with the original payment structure or the as-is option. If you were born before Jan. Inherited annuities come with a number of tax implications especially if the inherited beneficiary is a non-spouse.

You actually have two options if you decide to part with the inherited annuity. If youre the spouse of the original annuitant then you can choose to continue receive payments according to the annuity schedule. Find an advisor now.

The first is a partial sale. Any beneficiary including spouses can choose to take a one-time lump sum payout. An annuity normally includes both gains and non-taxable principal.

Nonspousal Inherited Annuity If youre a non-spousal beneficiary you may have the option to transfer the death benefit amount into a new inherited annuity. The timing of the tax event depends on the payout structure and your status as a beneficiary. Inherited Annuity Tax People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

If you want to simply take your inherited money right now and pay taxes you can. If the beneficiary is a spouse of the deceased annuitant they can carry on with the original annuity contract without any immediate tax implications. Keep in mind this provision only applies to spouseschildren named as beneficiaries must pay taxes on any inherited annuities.

Like any other type of income inherited annuities are taxable. If your father was older than 70 ½ you can use this web site to calculate the RMD. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of calculating your tax.

In general if you withdraw money from your annuity before you turn 59 ½ you may owe a 10 penalty on the taxable portion of the withdrawal. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an.

Tax Rules for Inheriting an Annuity.

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Exclusion Ratio What It Is And How It Works

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

Calculating Present And Future Value Of Annuities

Why You Should Create A Paper Trail For Your Heirs

Annuity Taxation How Various Annuities Are Taxed

Annuity Exclusion Ratio What It Is And How It Works

How Are Annuities Taxed For Retirement The Annuity Expert

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation How Various Annuities Are Taxed

Annuity Beneficiaries Inheriting An Annuity After Death

/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

Calculating Present And Future Value Of Annuities

![]()

Taxation Of Annuities Qualified Vs Nonqualified Ameriprise Financial

Inherited Annuity Tax Guide For Beneficiaries

Annuity Beneficiaries Inheriting An Annuity After Death

The Best Annuity Calculator 17 Retirement Planning Tools

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

:max_bytes(150000):strip_icc()/PresentValueAnnuityDue2-424480f4b7554eccae8e52f0ff327e8d.jpg)